Graduate Assistantship Information for Students

One of the most common sources of funding for graduate students are assistantships, which can support general administrative duties, teaching, or research projects. Assistantship policies are documented in University Policy No. 6210. A full assistantship requires a student to work for 20 hours per week on average. Departments may also offer partial assistantships. Students may or may not be required to report to work during school breaks. You can find some data on assistantship funding here.

How to Find an Assistantship

- Many departments evaluate graduate admission applications to match them with available assistantship positions. Most assistantship opportunities are managed at the department/program level and interested graduate students should contact the program of interest directly regarding funding opportunities. Review assistantship funding data to learn more about assistantship funding by degree level, program, assistantship type and more.

- Current students in the Blacksburg area seeking funding are encouraged to monitor GLC Weekly listserv postings for assistantship and wage openings that administrative offices share with the Graduate School. Current students in the greater Washington, D.C. metro area should monitor the D.C. Area Weekly newsletter postings.

- Student Affairs posts its available GA positions on their jobs portal.

Manage your Assistantship

- Quick guide for new GAs, GRAs, and GTAs.

- Making the Most of Your Assistantship

Graduate Assistant (GA)

Graduate Assistants provide academic and program support to academic, administrative or service units of the university. Responsibilities may be administrative in nature and consist of duties not directly related to teaching or research (such as academic advising, program planning, advising student groups, and assisting with the administrative duties of an office). GA responsibilities may also include grading examinations, problem sets, and/or lab assignments, setting up displays for lectures or laboratory sections, and preparing or maintaining equipment used in laboratory sections.

Graduate Research Assistant (GRA)

Graduate Research Assistants conduct academically significant research under the direction of a faculty member who is generally a principal investigator on an external grant or contract. GRAs are awarded by departments and professors who are engaged in research projects. Research assistantships offer exciting opportunities to participate in ongoing research developments at Virginia Tech. Since GRAs are often funded by sponsored research grants, they may be paid at a higher stipend level than GAs or GTAs. Students enrolled in Research & Dissertation (R & D) credit hours while holding a GRA position are expected to exert significant time and effort toward earning those credits in addition to fulfilling their assistantship duties. Please discuss expectations with your research advisor.

Graduate Teaching Assistant (GTA)

Graduate Teaching Assistants provide academic program support under the supervision of a faculty member. GTAs may assist faculty in teaching undergraduate courses, including laboratory teaching assignments, or in providing other appropriate professional assistance, including grading examinations, problem sets, and/or lab assignments, setting up displays for lectures and laboratory sections, and preparing or maintaining equipment used in lab sections. GTAs must have 18 hours of graduate-level course work completed in their teaching disciplines to be assigned full responsibility for teaching an undergraduate course. GTAs lacking this training will be assigned to work under the supervision of a faculty member who will be the instructor of record for the course.

The GTA workshop is held during the week before the start of each semester. All students holding a GTA appointment are expected to attend at the first available opportunity.

- Must be enrolled in 12-18 credit hours in fall and spring; audited courses do not count toward fulfilling this requirement.

- Maintain a 3.0 GPA; departmental requirements may be higher (provisional students with a GPA between 2.75 and 2.99 may also receive assistantships). Students whose GPA falls below 3.0 may remain on assistantship if their assistantship employer wishes to continue to support them. Exceptions are made on a semester-by-semester basis by the Graduate School.

- Make satisfactory progress toward degree as defined by academic departments and the Graduate School.

- Meet requirements to be eligible for employment in the U.S. You can find information about employment eligibility verification and tax forms from the Payroll Office, or review their website.

Assistantship in final semester:

- Students who enroll full-time may remain on their assistantship through the end of the semester in which they defend, regardless of when in the semester they defend and submit their ETD.

- Students who plan to defend early and leave the university during the fall or spring semester should not be on an assistantship but may be paid on wages or P14 appointment. Resigning early from an assistantship may result in prorated tuition responsibility for the student. Comprehensive fees are not prorated and are not refundable.

- Students who defend in the summer under SSDE may remain on assistantship in the summer if they were on assistantship in the spring.

The University provides an assistantship compensation package that is comparable with those offered by our peer institutions. The standard components of the compensation package, approved annually by the Board of Visitors, are:

- monthly stipend (paid semi-monthly according to the university's salary payroll schedule)

- in-state tuition scholarship in proportion to the assistantship FTE and contract period

- out-of-state tuition waiver (if eligibility requirements are met)

- health insurance subsidy (if eligibility requirements are met)

- payment plan for comprehensive and CFE fees (see below).

The stipend table for graduate assistants ranges from Step 1 to Step 50, representing a pay range within which graduate assistants must be paid. Departments determine which pay step to use based on the student's qualifications and experience, academic standing, and availability of funds. Departments have a wide range of stipend options to make competitive offers.

- 2025-26 Full-Time Graduate Assistantship Stipend Table (effective Aug 10, 2025-Aug 9, 2026)

- 2024-25 Full-Time Graduate Assistantship Stipend Table (effective Aug 10, 2024-Aug 9, 2025)

Taxes: Federal and state taxes, if applicable, are withheld from the assistantship stipend check, which is issued semi-monthly at approximately the first and sixteenth of each month. Students on summer assistantships who are not enrolled will be taxed at a higher, non-student rate.

During the academic year (Fall/Spring; tuition for summer and winter enrollment not included) students will receive a tuition remission for the in-state tuition, applicable program fee, and library and technology fees for the semester of their assistantship, in proportion to the assistantship appointment FTE and time period. Tuition remission is earned in 4-week increments, with full remission earned when students complete at least 16 weeks of work between the standard assistantship contract dates of the semester. If a student’s total stipend payments for the semester exceeds the combined amount of the standard department stipend amount plus the required in-state tuition, E&G and programs fees and the source of funding prohibits tuition payment, then tuition coverage by the department could be optional and the student would be required to pay their tuition and fee.

Payment of Comprehensive fees and CFE (Commonwealth Facility and Equipment) fees is not provided. Virginia residents should complete the In-State Tuition Request form in order to avoid being charged the CFE fees that out-of-state students are required to pay.

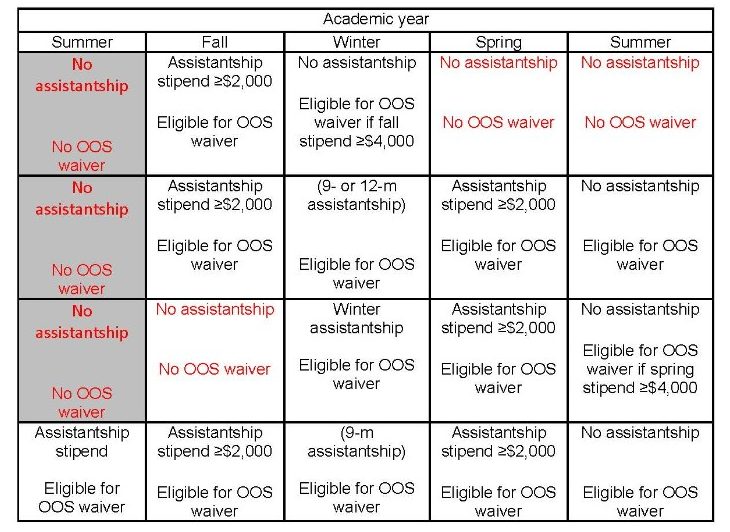

Graduate students who earn more than $4000 in an academic year on assistantship appointment(s) may be eligible for a waiver of the out-of-state portion of tuition for the year. This waiver does not apply to the Commonwealth Facility and Equipment (CFE) fee.

Summer earnings on assistantship or wage employment do not count towards meeting the $4000 minimum earnings requirement. Tuition bills from the Bursar's Office will show the out-of-state tuition charge and a credit to reflect the out-of-state tuition waiver (may also be referred to as "UF Differential"). Students who are enrolled in programs that have a program-specific graduate tuition rate (such as MIT, MNR, PSALS, and LGMC) are not eligible for the out-of-state waiver, since they are assessed a flat rate that is not residency specific.

The out-of-state tuition waiver is automatically applied to students' accounts when the following three criteria are met (this does not apply to level 46 bachelor's/master's students whose out-of-state tuition cannot be waived):

- the student's appointment (PAF) is entered in Banner by the hiring department

- the student meets the earnings criteria described above

- the student has registered for the semester

Virginia residents do not automatically receive in-state tuition status when they enter a graduate program at Virginia Tech, even if they were undergraduate students at Virginia Tech paying as an in-state resident. You must submit the In-State Tuition Request form to be qualified for in-state tuition. Also, any current student being charged out-of-state tuition and wishing to be considered for in-state rates must submit this form.

Eligibility for out-of-state waiver based on assistantship status and earnings:

- Fall: Must be on a GA/GTA/GRA and earn at least $2000 on assistantship stipend between Aug 10-Dec 24

- Winter: Must be on a GA/GTA/GRA and earn at least $2000 on assistantship stipend between Aug 10-Dec 24, or $4000 or more between Aug 10-May 9

- Spring: Must be on a GA/GTA/GRA and earn at least $2000 on assistantship stipend between Dec 25-May 9

- Summer: Must have been on a GA/GTA/GRA in immediately preceding spring semester and earned at least $4000 on assistantship stipend between Aug 10-May 9

Out-of-state tuition differential waiver eligibility chart

Graduate assistants who maintain at least a 50% assistantship (10 hours per week), may be eligible for health insurance benefits. Visit the Graduate School's insurance benefits webpage for additional information. Enrollment in the subsidized health insurance plan is available during the open enrollment period posted by the Student Medical Insurance office, and after your department has entered your assistantship appointment (PAF) in the HR system.

Comprehensive fees are a mandatory cost of attendance for students enrolling in Blacksburg that support the operation of self-funded (auxiliary enterprise) units providing services for the benefit of all students (recreational sports, Schiffert Health Center, Cook Counseling Center, Blacksburg Transit, etc). Services covered by these fees are accessible to students only in the semesters when they are enrolled. Students who are not enrolled during the summer semester may have the option of paying for certain individual services directly (Schiffert Health Center; Rec Sports).

Students are responsible for comprehensive fees each semester. Out-of-state students must also pay a Commonwealth Facilities & Equipment (CFE) fee. See the Bursar's web page for a description of fees. The CFE fee requirement cannot be waived and is not part of the tuition charges.

Graduate students on assistantship appointment may pay their comprehensive and CFE fees in installments through a payment plan during the fall and spring semesters. Enrollment is managed through Hokie SPA and students must sign up each semester in which they wish to take advantage of this opportunity. Enrollment is not available for the summer terms. Fully integrated with the students account system, the plan debits coincide with university payroll dates and adjust seamlessly with changes to the student account balance.

Enroll in the payment plan before the payment deadline to avoid late fees.

You may enroll in the plan only after you have registered for classes and after your tuition remission has been entered in the Banner system by the hiring department. If you are unable to enroll in the plan, please contact your assistantship department to ensure that they entered your tuition remission award. The projected debit amount and remaining debit dates will be displayed during the enrollment process. There is no cost to participate. Once enrolled in the program, you cannot cancel unless the balance is paid in full.

In recognition of students living and studying away from the Blacksburg campus, comprehensive fees may be reduced for students enrolled in an all virtual schedule or who have only research hours/ independent study not located on campus. Students must certify that they will reside more than 50 miles from the Blacksburg campus for the entire semester. More information can be found on the Bursar website. To be considered, this form must be submitted by the last day to add courses each semester.

Students offered an assistantship must electronically sign the Graduate Assistantship Contract, which is a contract between the student and department. Assistantship contracts can be accessed through onecampus.vt.edu, Graduate Contracts. All contracts stipulate start and end dates, type of appointment, monthly stipend, percentage of tuition remission, whether the student is expected to work during school breaks, and any other special conditions.

As with most professional appointments, work-time may vary from week to week. Students on a full assistantship (also referred to as 100%, 1 FTE), are expected to work an average of 20 hours/week during their contract period. Specific work assignments are provided by the employing departments. Contact your assistantship supervisor to discuss performance expectations; work schedule; first and last day of work for a semester (which may be different from the standard contract start/end dates); whether you need to work during school breaks, and other details.

Students enrolled in Research & Dissertation (R & D) credit hours while holding an assistantship position are expected to exert significant time and effort toward earning those credits in addition to fulfilling their assistantship duties. Please discuss expectations with your research advisor.

Students receiving financial aid need to report their assistantship compensation, including stipend, tuition scholarship, and out of state waiver, to their financial aid counselors.

Graduate students on full assistantships are not prohibited from seeking additional employment (some restrictions apply: assistantships cannot be combined with P14 appointments; immigration regulations further govern international student employment). Students should consult with their academic advisor and/or assistantship supervisor as applicable regarding the fulfillment of their assistantship and graduate study responsibilities. Students must notify the Graduate School about any additional employment, including the period of employment, name and contact of employer, and job title or short description of duties. Use the online tool for reporting:

Five-year bachelor/master's students can hold assistantships in the last semester of their senior year and receive an in-state tuition scholarship, but their out-of-state fees cannot be waived. Bachelor/Master's students in the last semester of their senior year (level 46 students) who are offered assistantships cannot accept funds from the undergraduate scholarship funds and the graduate scholarship funds concurrently. Departments should discuss with each student the scholarship options before awarding an assistantship and issuing an agreement.

When a contract is terminated prior to its end date, the department must inform the Graduate School using this form.

If an assistantship is terminated prior to the completion of the academic semester, the remission of tuition and E&G fees will be prorated in four week increments, with each quarter of tuition earned by the completion of four full weeks of work and full remission earned only if the student completes the assistantship (16 full weeks or more in a semester). Other benefits, such as health insurance subsidy and out-of-state tuition waiver, will be recalculated based on eligibility requirements, and the student will be billed for the remaining balance

The table below details the tuition obligations for students who leave the assistantship appointment before the semester is complete. The table is also available in pdf format.

Refer to the Bursar's Office website for policy on refunds for resignations and reduced course loads.

Tuition Proration for Late Start or Early Termination of Assistantships (revised 2025)

| NUMBER OF WEEKS WORKED IN THE SEMESTER WHEN ON ASSISTANTSHIP | Student OBLIGATION of tuition, program, and E&G fees(percentage of responsibility of charged amount) | Department OBLIGATION of tuition, program, and E&G fees (percentage of responsibility of charged amount) | Fall Dates for EarlyTermination withStandard Start date of Aug 10 | Fall Dates for Delayed start with Standard end date of Dec. 24 | Spring Dates for early termination with standard start date of Dec 25 | Spring Dates for delayed start with standard end date ofMay 9 |

Less than four weeks (less than 28 calendar days) |

100% |

0% |

Termination date before 9/6 |

Start after 11/27 |

Termination date before 1/21 |

Start after 4/12 |

Four weeks through seven weeks and 6 days |

75% |

25% |

Termination date 9/6‐10/3 |

Start date 10/31 ‐11/27 |

Termination date 1/21 ‐ 2/17 |

Start date 3/16 ‐ 4/11 |

Eight weeks through eleven weeks and 6 days |

50% |

50% |

Termination date 10/4‐10/31 |

Start date 10/3‐10/30 |

Termination date 2/18 ‐ 3/17 |

Start date 2/16 ‐ 3/15 |

Twelve weeks through fifteen weeks and 6 days |

25% |

75% |

Termination date 11/1‐11/28 |

Start date 9/5‐10/2 |

Termination date 3/18 ‐ 4/14 |

Start date 1/19 ‐ 2/15 |

Sixteen weeks or more (full semester) |

0% |

100% |

Termination date on or after 11/29 | Start on or before 9/4 |

Termination date on or after 4/15 | Start date on or before 1/18 |

Standard assistantship contract start and end dates are the same each year to provide 9 pay periods a semester regardless of the actual semester start/end dates. Assistantship benefits such as the health insurance subsidy are distributed evenly through the 18 pay periods in an academic year. Your reporting to work date and last day of work might be different from the contract start/end dates, including starting to work later than the contract start date and working some days beyond the official contract end date. Work with your supervisor on determining the actual start/end dates.

Standard assistantship appointments:

Academic Year: Aug 10 through May 9

Fall Semester: Aug 10 through Dec 24

Spring Semester: Dec 25 through May 9

Summer: May 10 through August 9

Departments must specify whether a student is to work over school- or semester breaks. Students may be offered assistantships at any time of year. Tuition remission is prorated based on percentage and length of contract.

For assistantships starting on Aug 10, the first paycheck is on Sep 1.

Changes to deductions

Virginia Tech follows the safe harbor outlined in Revenue Procedure 2005-11. All graduate students employed by and enrolled at VT in at least 5 credit hours in fall/spring/summer will be exempt from FICA taxes; students who are not enrolled in the summer while on assistantship are subject to FICA taxes on their earnings. Students who work during breaks and are not enrolled will have Social Security and Medicare withheld from their pay over the break.

Access to services

Services such as recreational sports, Schiffert Health Center, Cook Counseling Center, Student Legal Services, etc., are covered by comprehensive fees, which are mandatory when students are enrolled. If not enrolled in the summer, students on summer assistantship have the option of paying for certain services directly (Cook Counseling; Schiffert Health Center; Rec Sports) if they wish to use these. Day-use charges for Cook Counseling and Schiffert Health Center are reimburseable by the Aetna Student Insurance sponsored by VT, regardless of how often the service is used. However, payment of the full summer health services fee is not a reimbursable expense. For more information on reimbursable expenses, contact the Student Medical Insurance office at smi@vt.edu; 540-231-6226.

For workplace accommodations, graduate assistants should contact the Office of Civil Rights Compliance and Prevention Education at adaaccess@vt.edu or call 540-231-1048. This also includes potential accommodations related to pregnancy, complications of pregnancy, and childbirth, as covered by the Pregnant Workers Fairness Act (PWFA) . Reasonable accommodations under the PWFA may include flexible working hours, appropriately sized uniforms and safety apparel, exemption from strenuous activities or other adjustments. For additional guidance regarding the PWFA, review the VT PWFA guide or direct questions to CRCPE at civilrights@vt.edu or 540-231-2010.

For academic accommodations, graduate assistants should contact The Office of Services for Students with Disabilities at ssd@vt.edu or call 540-231-3788.

The Work-Life Grant Program provides temporary financial assistance to departments to enable them to continue assistantship stipend funding for graduate students during pregnancy and childbirth or potentially other major medical issues.

Academic supervision for this purpose is defined as teaching or being an assistant for a course; holding office hours as a GA or GTA; grading or proctoring for a course; formal research mentor or academic responsibilities; or other formally designated educational responsibilities associated with GA, or GTA duties.

Professional supervision for this purpose is defined as overseeing another student’s research progress, whether by serving as their mentor/advisor or supervising the tasks expected of them; providing feedback; or being directly involved with their professional review as part of expectations of their GRA duties.

The relationship between someone with paid (by GA or GTA) academic supervision and/or professional supervision (GRA) and the student they have supervision over plays an important part in achieving an “inclusive community of knowledge, discovery, and creativity” as outlined by the university’s mission statement. Those with academic and/or professional supervision have a responsibility to encourage the pursuit of learning and maintain a respectful and supportive environment where applicable for their students. To maintain an ethical, reproachless, respectful and supportive environment:

- No GA, GTA, or GRA shall attempt to initiate or engage in an intimate or sexual relationship with any student they have academic and/or professional supervision over, be it a graduate student or undergraduate student before the academic and/or professional supervision has concluded and, if applicable, a final grade on the student’s academic performance has been submitted to the Registrar.

- No GA, GTA, or GRA shall attempt to initiate or accept amorous or sexual advances with a student they have academic and/or professional supervision over, be it a graduate student or undergraduate student, before the academic and/or professional supervision has concluded and, if applicable, a final grade on the student’s academic performance has been submitted to the Registrar.

In the event of a pre-existing relationship, the GA, GTA, or GRA is required to disclose the relationship in writing to the relevant department supervisor or department chair before their role begins. The department supervisor or chair must respond in writing to acknowledge the relationship and adjust positions appropriately so that a conflict of interest no longer exists in the academic and/or professional supervision role.

Failure to follow the above procedures to ensure a respectful and supportive environment for students may result in loss of GA, GTA or GRA funding if applicable. Additionally, failure to follow these procedures may result in a referral to the Office of Student Conduct for consideration of appropriate disciplinary action under the Student Code of Conduct.

This policy is superseded by university policy 1025 and 1026 in the event of alleged nonconsensual sexual activity.

For the latest news on available assistantships, read the GLC-programs weekly listserv, published every Monday.